Photo credit: U.S. Defense Department

Context:

Borrowing money to pay for war leads to greater social inequality and allows governments to shield the public from direct costs of war-leading to higher war support and approval ratings, and less budget oversight.

In the News:

“Government borrowing to pay for wars leads to greater social inequality in the aftermath of the war. This happens when wars are paid for via general public debt versus a war bond campaign, particularly when combined with indirect taxes (such as sales, value-added, excise, and customs taxes) or a tax cut. Conversely, wars financed via bond campaigns targeted to low- and middle-income populations and direct taxes (such as income, property, and corporate taxes) result in greater social equality.

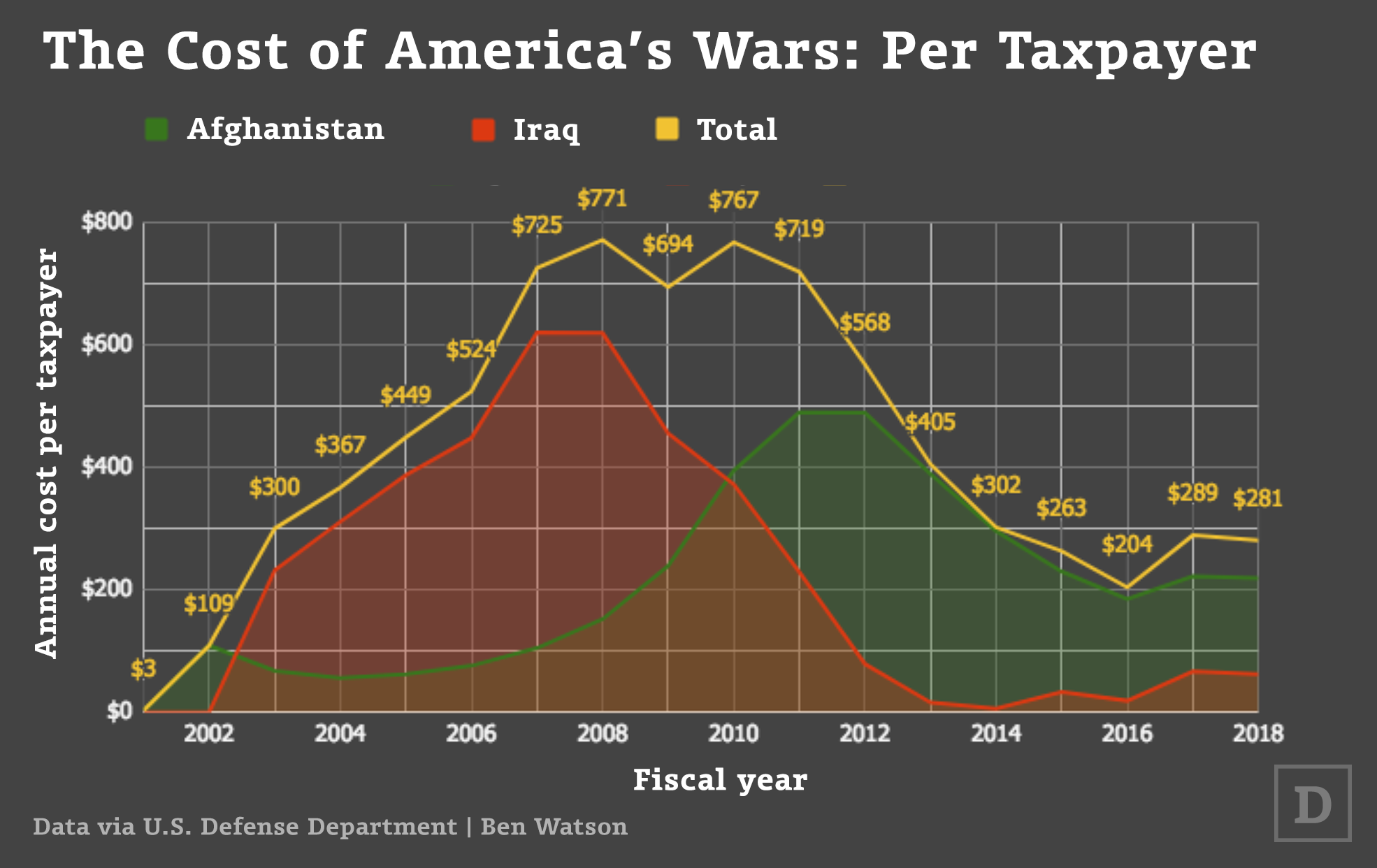

“The share of national income held by the wealthiest Americans dropped dramatically during World War I, World War II, and the Korean War, when bond campaigns and direct taxation characterized US war finance strategy. In other words, these wars are associated with progressive wealth redistribution. During the Vietnam War, the relationship between war finance and inequality varied. The 1965 tax cut, deficit war financing, and subsequent inflationary effects resulted in greater inequality. But once the 1968 tax increase was implemented, inequality declined as the tax increase mitigated rising prices and reduced reliance on deficit financing. The Gulf War, due to its financing via allied grants and short duration, created few if any redistributive effects. The era of the Global War on Terror, which began with a tax cut, followed by more tax cuts, saw its war financed by foreign debt and generally floated domestic debt. It appears to be associated with increasing inequality as the share of fiscal income held by the top one percent of wealthy Americans has trended upward.”

“This paper predicts that unless there is a shift in US war finance away from deficit financing and continual tax cuts, inequality will continue to increase along with the post9/11 wars. In order to mitigate rising inequality in the US, the American government should begin to pay for at least a portion of future Global War on Terror operations outright via direct taxation”

Support from Peace Science:

War support is directly linked to how governments choose to finance their wars: debt or taxes.

- War support is significantly reduced when war is financed through taxes instead of through borrowing money.

- When wars are paid through taxes, war support decreases by around 15% because individuals are directly impacted by the economic costs of war.

- The decrease in public support for war when the public is taxed is consistent across party lines, types of conflict, and countries analyzed.

- Borrowing money for war allows governments to shield the public from direct costs, leading to higher war approval ratings and less oversight.

References:

- “How Do War Financing Strategies Lead to Inequality? A Brief History from the War of 1812 through the Post-9/11 Wars” by Rosella Cappella Zielinski for Brown University’s Costs of War project. June 28, 2018.

- Peace Science Digest: Volume 3, Issue 2: “War Finance Methods and Public Support for War”