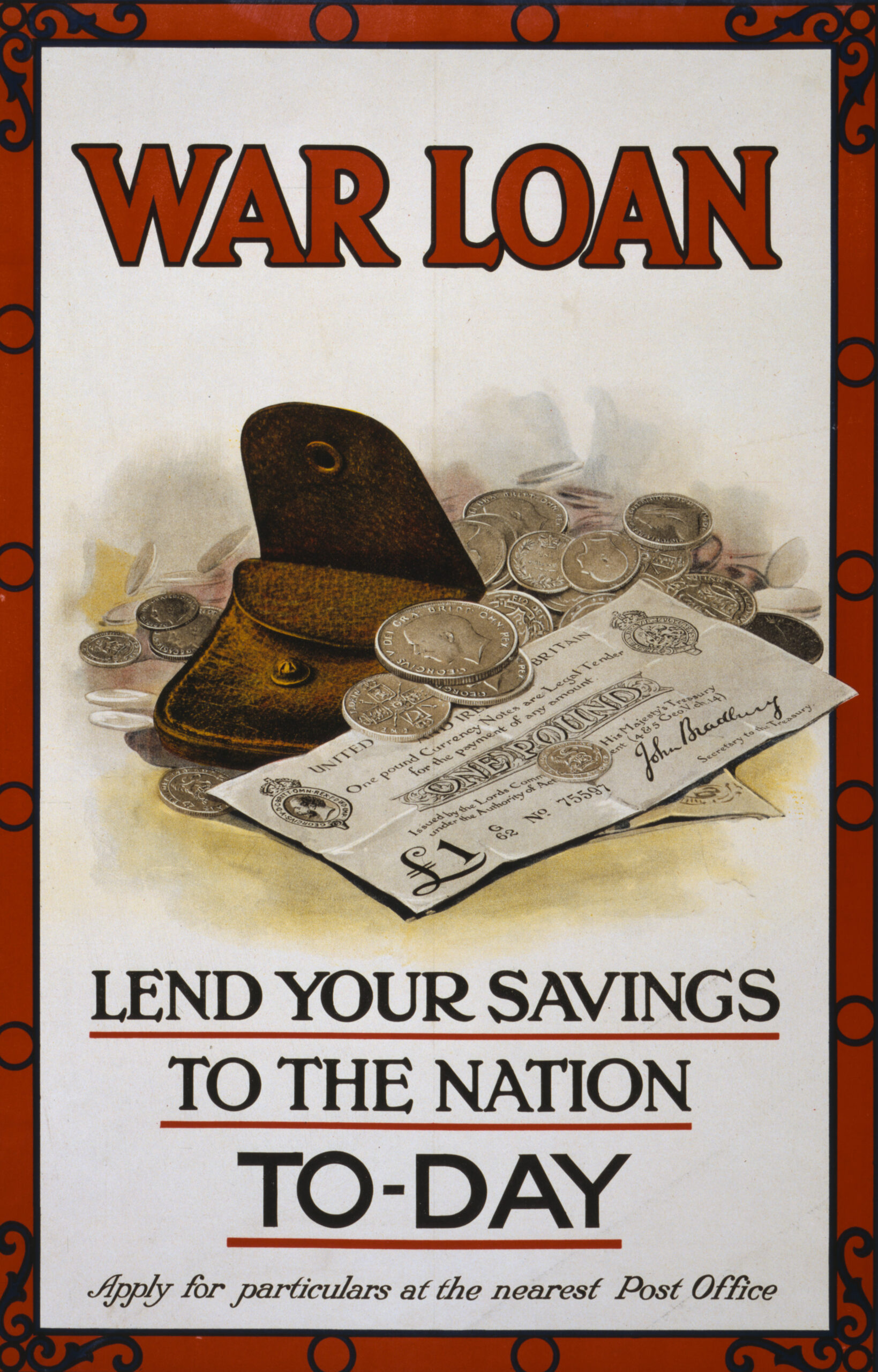

Photo credit: pingnews.com via flickr

This analysis summarizes and reflects on the following research: Flores-Macías, G.A., & Kreps, S.E. (2017). Borrowing support for war: The effect of war finance on public attitudes toward conflict. Journal of Conflict Resolution, 61(5), 997-1020.

Talking Points

- War support is significantly reduced when war is financed through taxes instead of through borrowing money.

- When wars are paid through taxes, war support decreases by around 15% because individuals are directly impacted by the economic costs of war.

- The decrease in public support for war when the public is taxed is consistent across party lines, types of conflict, and countries analyzed.

- Borrowing money for war allows governments to shield the public from direct costs, leading to higher war approval ratings and less oversight.

Summary

There are two primary ways countries finance their wars: through borrowing money or by taxing their citizens. Each of these finance options affects the economy differently, and presumably opinions on war will vary based on how the costs of war are reflected in the day-to-day lives of those paying for it. Although numerous studies have examined the way public support for war is influenced by the costs of war—through lives lost and injuries suffered by combatants, military families, and communities—fewer studies have examined the way public support for war is influenced by the way it is financed. In this article, the authors conduct a study to measure if the way countries finance war has a noticeable effect on the public’s support for that war.

Theories of democratic accountability, beginning with Immanuel Kant in 1775, have long argued that, although democracies engage in war, the costs of war will be heavily scrutinized because the citizens in a democracy will ultimately bear the expense and will therefore hold their leaders accountable for the total costs. This theory, however, predates today’s borrowing economy where governments can acquire debt instead of implementing taxes to pay for wars. Importantly, the authors point out, modern wars waged by the U.S. have all been financed entirely through borrowing money, breaking away from the long-standing tradition of a “war tax” that paid for previous U.S. wars.

The authors argue that how individuals experience the financial costs of war will affect their attitudes toward war and the pressure they apply on their leaders, as taxation has a “direct impact on an individual’s purchasing power and draws an explicit connection between the individual and the war, whereas the costs of borrowing are deferred.” The “explicit connection” of taxation is important because it makes the prospect of a war financed through taxes less agreeable to the public compared to a war financed through borrowing, which lacks the direct financial consequence to the public and in turn may translate into greater public support for a non-taxed war. In short, the authors propose that borrowing as a form of war finance is tantamount to borrowing public support for war.

To test their theory, the authors conducted surveys in the United States and the United Kingdom to measure if the method by which war is financed in a democracy is an important factor in the public’s support for that war. They asked over 5,000 survey respondents about the level of war support for a hypothetical war and measured variations in the type of conflict, the method of finance (borrowing money or taxes), the political party of the respondent, and the type of political system under which the respondent lived.

The results of the study show a clear connection between how a war is financed and the level of public support for the war. Individuals were much more sensitive to the costs of war when they were connected to the financial burdens through taxes rather than through debt. Decreased support for war when financed by taxes was consistent no matter the type of conflict, the country analyzed, or the political party or system of governance. Depending on the variable, when war was financed by taxes, public opinion decreased by an average of 11% and in some cases even by 16%. This is a very significant difference in support, more than would be enough to shift a minority opinion to the majority, should a congress or parliament be called upon to vote on going to war.

Contemporary Relevance

The “War on Terror” provides a glaring example of defense spending and the role it plays in a national economy. The total United States spending for the wars in Iraq and Afghanistan totals somewhere between $2 to $5 trillion dollars—and the price tag surpasses $6 trillion when accounting for the entire “War on Terror.” This is shocking, especially when compared to the $4 trillion (adjusted for inflation) spent on World War Two. By 2023, the U.S. plans to spend $726 billion on defense, nearly 65% of the entire discretionary budget.[1] The vast majority of this money will be borrowed and, as this research points out, people are much less likely to disagree with massive defense spending when that is the case because of the way debt protects individuals from the economic burden of war.

One of the most significant implications of the above research is the additional leeway borrowing grants our political leaders. Because the public is not directly burdened when financing war via borrowing, the deferred debt means the public has fewer reasons to rein in exorbitant costs. As the authors point out, borrowing to finance war “enables leaders to sustain public support—or at least minimize opposition—by shielding the public from the direct costs of war.” Furthermore, the strong economies of the U.S. and the United Kingdom make borrowing easy and inexpensive compared to the rest of the world, so they are likely to continue borrowing and will be able to outspend any opponents who would borrow at higher interest rates or levy taxes to finance their war-fighting ability.

Practical Implications

Part of the reason war fighting is such a common policy option for the United States is because the majority of its citizens have no direct connection to, and thus remain relatively unaffected by, the high human and economic costs of war. In the U.S., the national draft ended with the Vietnam War, leaving most of today’s military enrollment to communities of color and/or low-income people, further perpetuating many of the damaging social institutions already in place. However, one thing that everyone from every community shares is a connection to the economy and their interest in how a changing economy, or a change in taxation, may affect their individual economic situation. Borrowing money to pay for wars all but removes this connection between the individual and war spending, but as the above research shows, a war tax can make the costs of war much more personal for all.

To bring attention to the growing national debt stemming mainly from U.S. defense spending, war resisters can consider pushing for a war tax in the U.S. By demanding that Congress pay for all military expenditures directly through a special tax, one could expect immediate voter attention—and apprehension—the next time the military is called up.

Furthermore, a war tax would increase the likelihood of congress actually voting on military action, which they are constitutionally required to do. Since the beginning of the “War on Terror,” the U.S. Authorization for the Use of Military Force (AUMF), passed and signed into law in mid-September 2001, has made it easy for U.S. presidents to work around these votes.

Continued Reading

We Need a War Tax: the only way for anti-interventionists to succeed is to set specific policy goals By Noah Berlatsky. Slate.com, April 24, 2017. http://www.slate.com/articles/news_and_politics/politics/2017/04/trump_s_newfound_militarism_shows_why_we_need_some_kind_of_a_war_tax.html

What if they gave a war and nobody paid? By David Hartsough. Waging Nonviolence, March 26, 2013. https://wagingnonviolence.org/feature/what-if-they-gave-a-war-and-nobody-paid/

Keywords: costs of war, democracy, war finance, war support

Footnotes

[1] National Priorities Project. Trump Budget Request Takes Military Share of Spending to Historic Levels. Feb. 15, 2018. https://www.nationalpriorities.org/analysis/2018/trump-budget-request-takes-military-share-spending-historic-levels/

The following analysis is from Volume 3, Issue 2 of the Peace Science Digest